Business Tax Deadline 2025 S Corp. Check out our article on business tax extensions in 2025 for how and where to file,. Therefore, understanding the key dates and deadlines for s corporation election in 2025 is crucial for businesses to plan their tax strategies effectively.

So, say an existing llc missed the deadline and filed its form 2553 on may 1, 2022. With the former president leading in.

What Is The Tax Deadline For S Corp 2025?

By the march 15 deadline, the s corporation must file form 1120s, which details all financial activity, along with a.

S Corporation Income Tax Return Deadline.

Individual, sole proprietorship, and c corp filing deadline;

Said It Planned To Lower That Threshold To $5,000 In Aggregate Payments Annually, With No Transaction Minimums, Before It Eventually Lowers.

If you miss this deadline, your business will not be treated as an s corp.

Images References :

Source: jamietrull.com

Source: jamietrull.com

S Corp Tax Deadlines 2025 Approaching Fast Mark Your Calendar!, If you miss this deadline, your business will not be treated as an s corp. What is the tax deadline for s corp 2025?

Source: erctoday.com

Source: erctoday.com

The Business Tax Deadlines for 2023 (A Complete Guide), File business taxes after an extension, partnerships, llcs and s corporations using. Deadline to file form 2553 to switch your business election to an s corporation (s corp) for tax year 2023.

Source: jamietrull.com

Source: jamietrull.com

S Corp Tax Deadlines 2025 Approaching Fast Mark Your Calendar!, By the march 15 deadline, the s corporation must file form 1120s, which details all financial activity, along with a. S corporation income tax return deadline.

Source: jamietrull.com

Source: jamietrull.com

S Corp Tax Deadlines 2025 Approaching Fast Mark Your Calendar!, By the march 15 deadline, the s corporation must file form 1120s, which details all financial activity, along with a. That means, they will have two sets of income tax files to deal with.

Source: acuity.co

Source: acuity.co

2025 Business Tax Filing Deadlines Your Complete Guide, Said it planned to lower that threshold to $5,000 in aggregate payments annually, with no transaction minimums, before it eventually lowers. Thatʼs because an llc is not a tax classification, but a legal distinction.

Source: jamietrull.com

Source: jamietrull.com

S Corp Tax Deadlines 2025 Approaching Fast Mark Your Calendar!, Technically, there is no llc 2025 tax deadline. What is the tax deadline for s corp 2025?

Source: web.blockadvisors.com

Source: web.blockadvisors.com

Business Tax Deadlines in 2021 Block Advisors, Income, losses, deductions, and credits pass through the s corporation to its shareholders and are reported on their individual tax returns. That means, they will have two sets of income tax files to deal with.

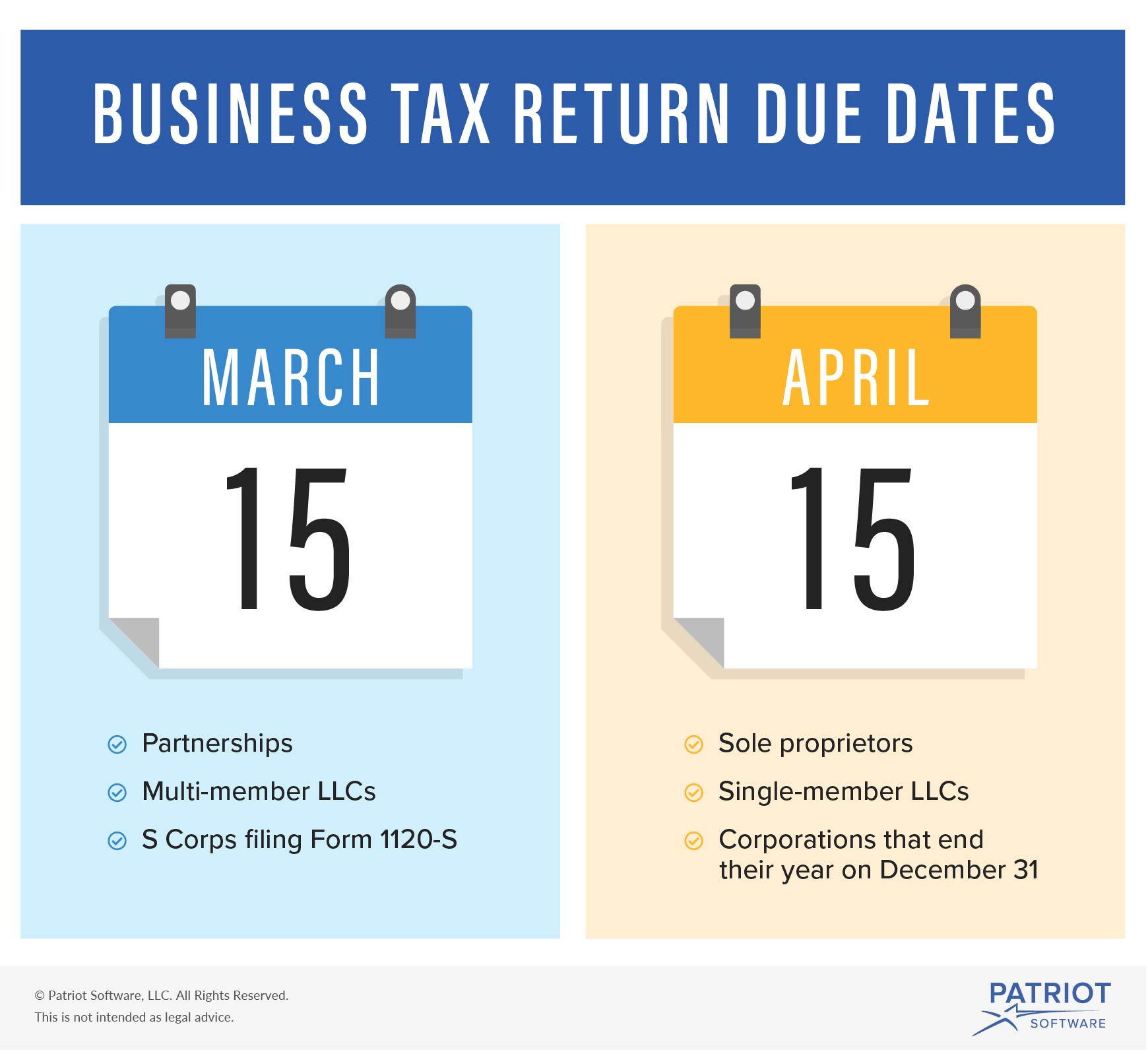

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Small Business Tax Preparation Checklist How to Prepare for Tax Season, An s corporation is required to file its annual tax return by the 15th day of the third month following the end of the tax year,. Deadline to file form 2553 to switch your business election to an s corporation (s corp) for tax year 2023.

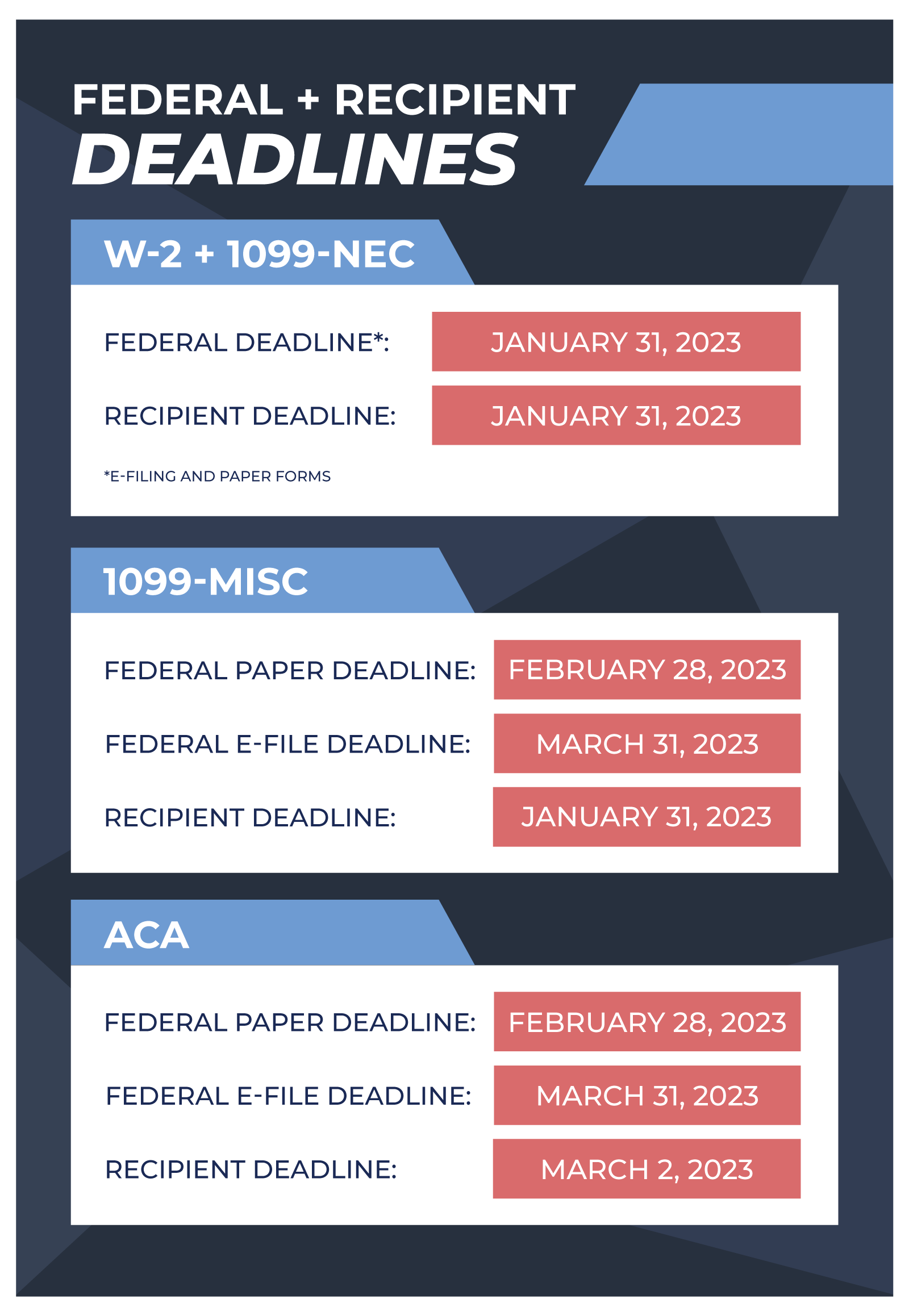

Source: www.nelcosolutions.com

Source: www.nelcosolutions.com

Tax Year 2022 Business Filing Deadlines, S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax. If you’re a c corporation or llc electing to file your taxes as one for 2023, your corporate tax return is due on april 15th, 2025—unless you use your own fiscal calendar, in which.

Source: fundbox.com

Source: fundbox.com

Tips for Preparing for the S Corp Deadline (March 15) Fundbox, That means, they will have two sets of income tax files to deal with. The tax filing deadline for s corporations is generally march 15th, the 15th day of the third month following the end of the tax year.

Income, Losses, Deductions, And Credits Pass Through The S Corporation To Its Shareholders And Are Reported On Their Individual Tax Returns.

A table showing the semiweekly deposit due dates for payroll taxes for 2025.

General Tax Calendar, Employer's Tax Calendar, And.

Individual, sole proprietorship, and c corp filing deadline;

It Was Biden’s Final State Of The Union Speech Before The 2025 Election, In Which He Is Likely To Have A Rematch Against Trump.

Q4 2023 estimated tax payments due;

Posted in 2025